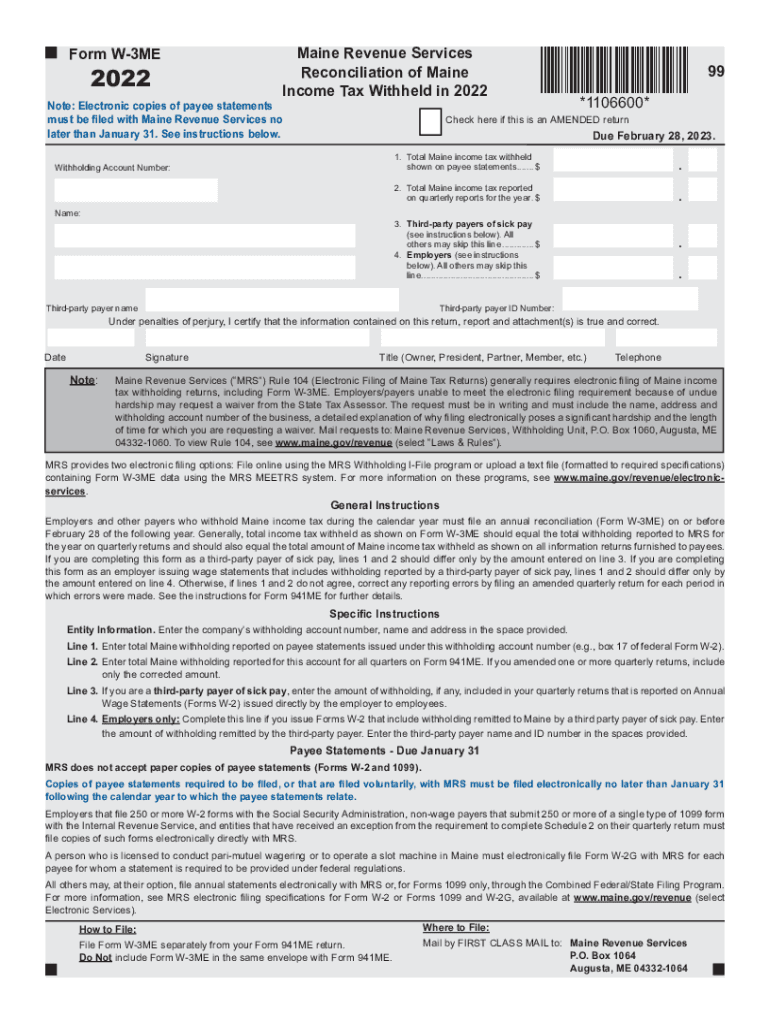

Maine Estimated Tax Payments 2025. Quarterly payroll and excise tax returns normally due on jan. Quarterly payroll and excise tax returns normally due on jan.

Quarterly estimated income tax payments normally due on jan. Quarterly estimated income tax payments normally due on jan.

You can quickly estimate your maine state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare.

This new relief related to the january 2025 storms will extend certain filing and payment due dates for taxpayers in those counties through july 15, 2025.

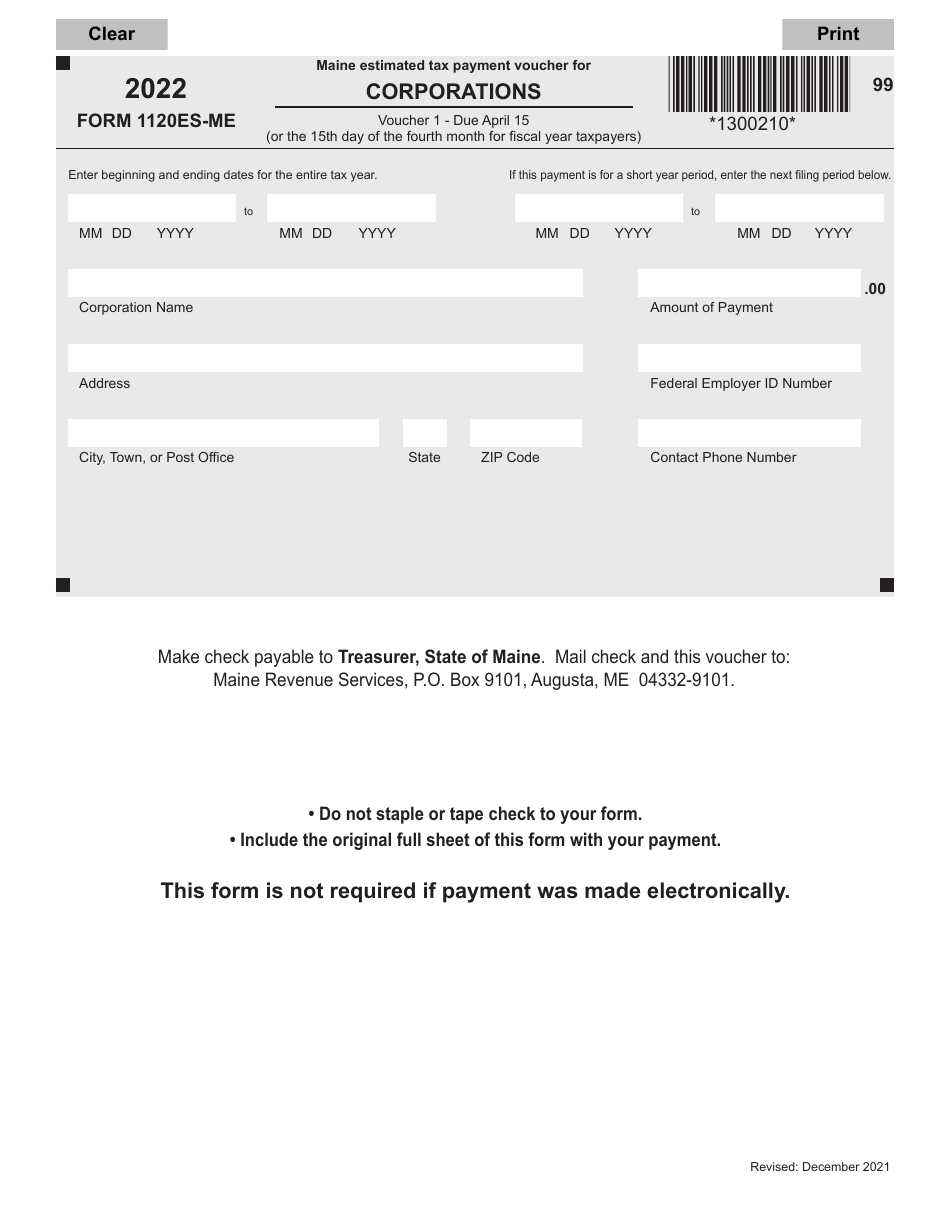

Form 1120ESME Download Fillable PDF or Fill Online Maine Estimated Tax, The maine tax portal can now be used for most business and individual state taxes. Quarterly estimated income tax payments normally due on jan.

1120me instructions Fill out & sign online DocHub, • 2025 contributions to iras and health savings accounts for eligible taxpayers. The maine tax portal is being rolled out in phases and will be open for all maine taxpayers by the end of 2025.

1949.819k Salary After Tax in Maine US Tax 2025, Between august 1 and december 31 of year following tax payment(s) • timing of some tax year 2025 and 2025 revenues differed from prior years • some ty 2025 payments with extension received in calendar year 2025 were.

Maryland Estimated Tax Vouchers 2025 Irina Leonora, You must send a payment for taxes in maine for the fiscal year 2025 by march 15, 2025. Tax season is underway, with maine revenue services and the irs processing 2025 individual income tax returns.

Maine tax forms 2025 Fill out & sign online DocHub, You can quickly estimate your maine state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare. This new relief related to the january 2025 storms will extend certain filing and payment due dates for taxpayers in those counties through july 15, 2025.

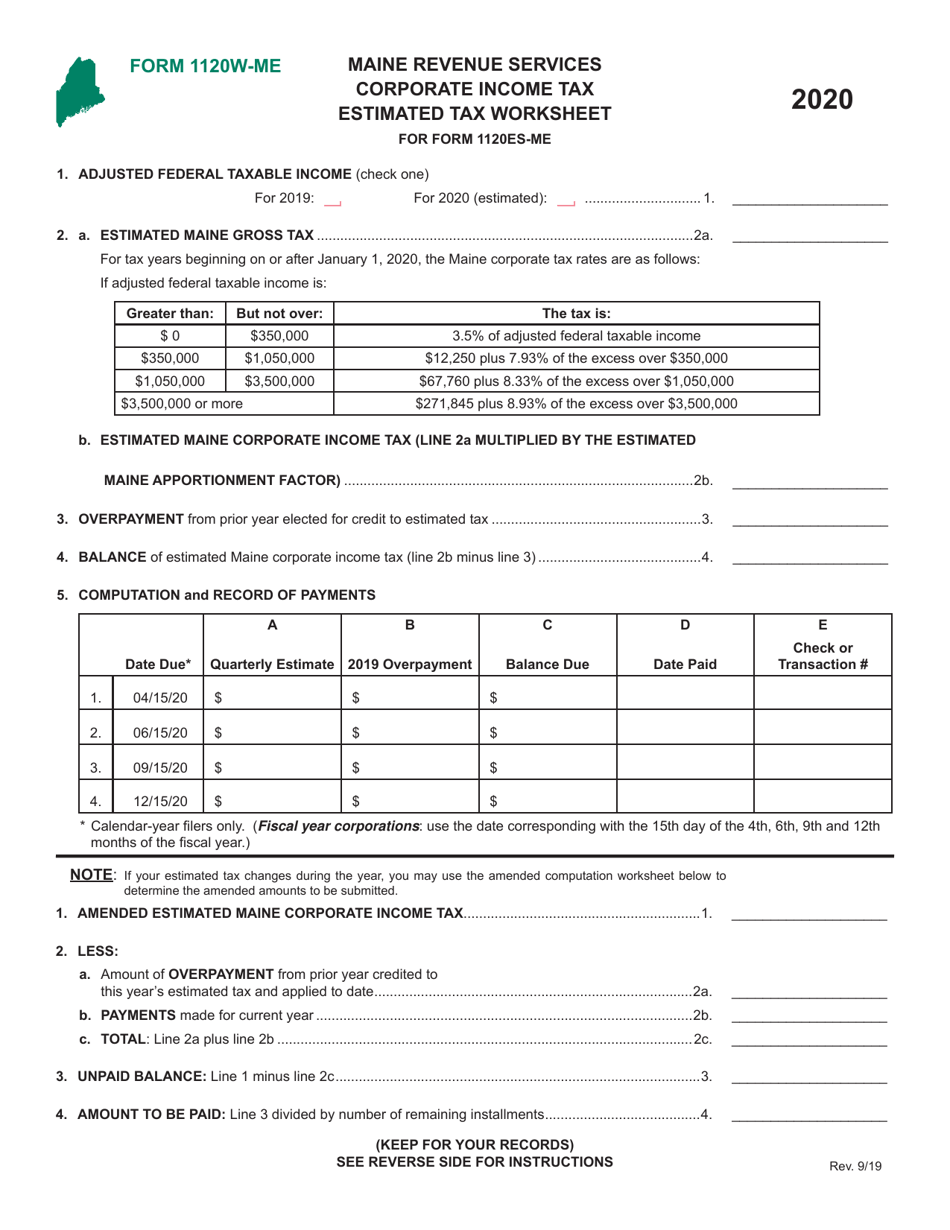

Form 1120WME Download Printable PDF or Fill Online Corporate, You must send a payment for taxes in maine for the fiscal year 2025 by march 15, 2025. 16 and april 15, 2025.

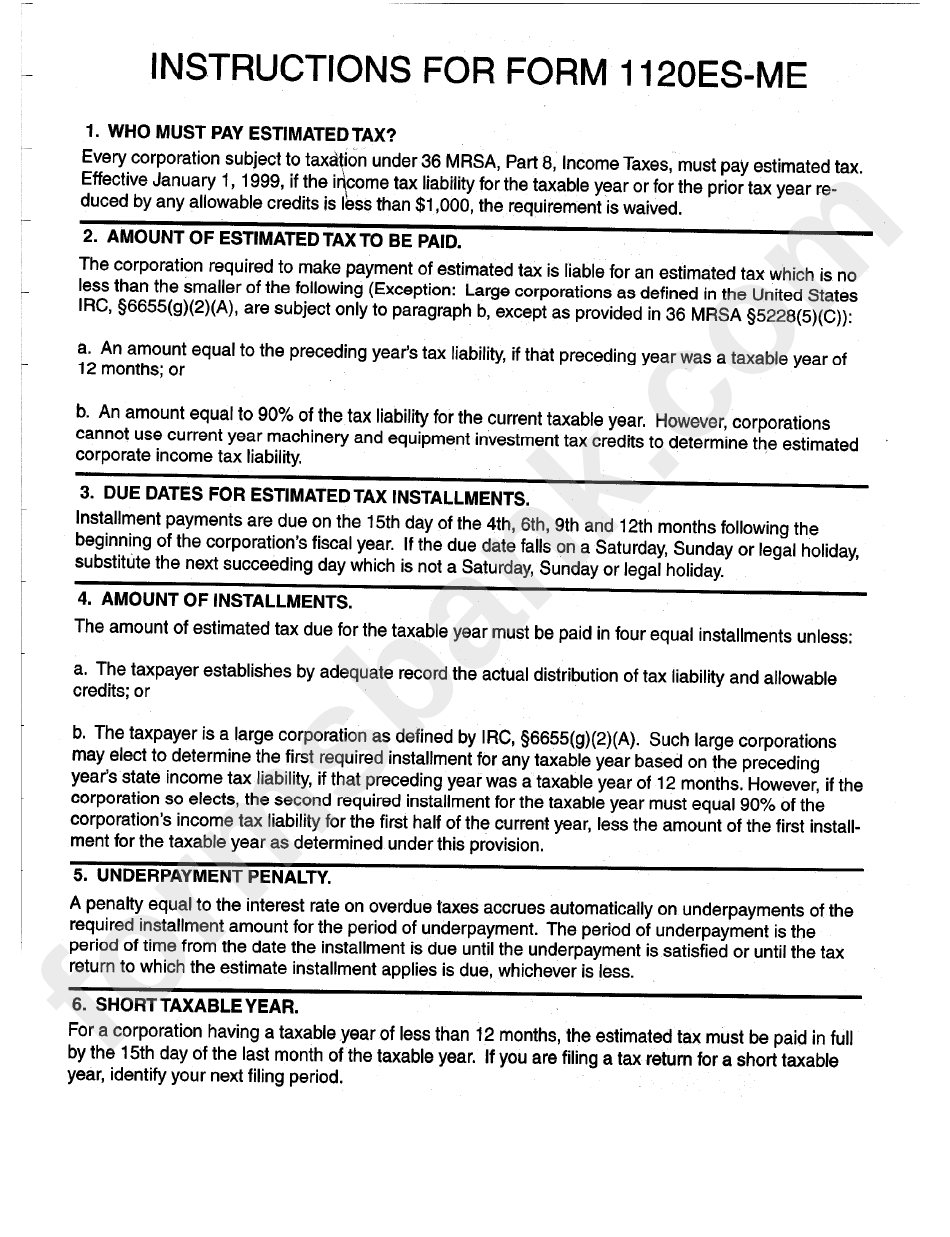

Instructions For Form 1120EsMe Maine Estimated Tax Payment Voucher, 16 and april 15, 2025. Quarterly estimated income tax payments normally due on jan.

Maine tax Fill out & sign online DocHub, Extremely strong final estimated payments for tax year 2025 and withholding payments during the first half of cy 21, and a shift in a portion of the negative revenue impact of. In maine, the deadline is wednesday,.

2040.644k Salary After Tax in Maine US Tax 2025, Quarterly estimated income tax payments normally due on jan. The maine tax portal is being rolled out in phases and will be open for all maine taxpayers by the end of 2025.

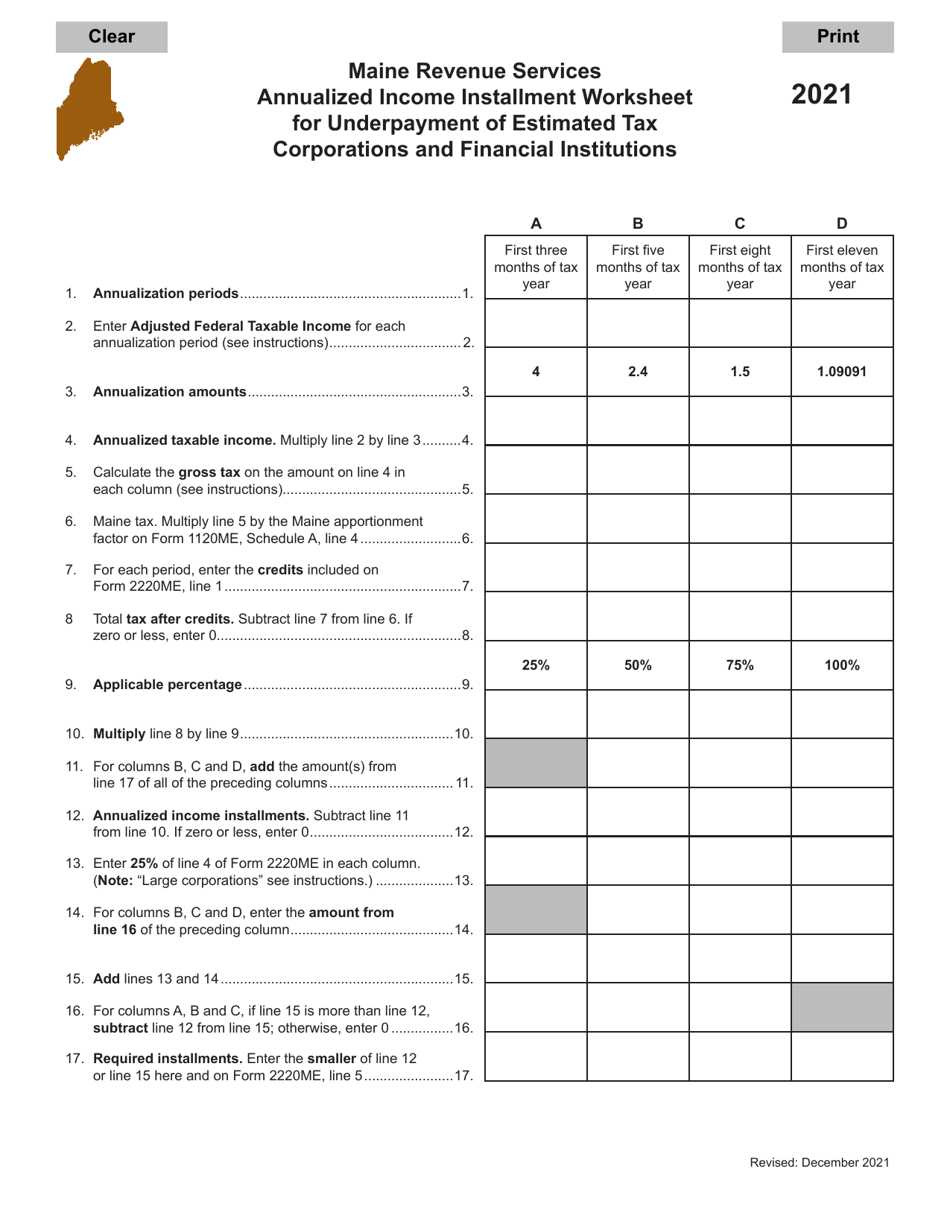

2025 Maine Annualized Installment Worksheet for Underpayment of, For affected maine taxpayers in these three counties, tax returns and final or estimated payments originally due on or after december 17, 2025, and before july 15, 2025 for. For affected maine taxpayers in these three counties, tax returns and final or estimated payments originally due on or after december 17, 2025, and before july 15,.

If your 2025 tax liability was $1,000 or more, you should refer to form 2210me, underpayment of estimated tax by individuals.

Maine revenue services released the individual income tax rate schedules and personal exemption and standard deduction amounts, which are adjusted for.